Fall 2022

Confronting Challenges in Supply Chain Policy

The Wilson Center’s resident supply chain expert leads a conversation between General Motors’ head of global policy and a fmr. Commerce Dept. official about supply chain policy.

In this multi-media feature, Duncan Wood, vice president of strategy and new initiatives at the Wilson Center, speaks with two prominent experts: Jasper Jung, who leads global public policy for General Motors, and Cordell Hull, former acting undersecretary of commerce. Together, they provide a close look at the unique challenges in creating supply chain policies that work for business, government, and the economy.

Unedited Transcript:

Duncan Wood:

Hello, from the Wilson Center in Washington DC. I'm Duncan Wood, the Center's Vice President of Strategy and New Initiatives. It's a great pleasure to welcome you to this multimedia feature as part of the Wilson quarterly's fall issue titled, As Strong as Our Weakest Link. It examines global supply chain vulnerabilities and innovative solutions to help policy makers, businesses and consumers understand and prepare for future shocks. To provide a close look at the unique challenges in creating supply chain policies that work for business, government and the economy, two prominent experts join me today, Jasper Jung, who leads strategic initiatives for General Motors and Cordell Hull, former acting undersecretary of commerce. Thank you both for being part of this important conversation and welcome.

Cordell Hull:

Thank you.

Jasper Jung:

Thank you.

Duncan Wood:

Let's begin with you, Cordell. You've been focused on the policy end of supply chains for quite a while, and it's important to remember that all of this began before the Biden administration or the Biden administration has achieved prominence with this work. But it's been going on for a while. And I wonder if you can tell us, what have you seen in terms of the development of thinking about supply chains in particular government strategy, and what are the major challenges that need to be overcome?

Cordell Hull:

Sure. Well, as you mentioned, it's an issue that I focused on for a number of years and dating back to my time in Congress, working in Congress, focused more on the military and the intelligence side of things where we were of course very concerned about supply chains for a variety of reasons, including technical, ensuring that the products we're getting are not technically compromised and ensuring supply assurance. But with respect to serving in the Department of Commerce, it's certainly something the department has focused on for a long time. And it's something that unfortunately, COVID brought into a tragic and sharp relief, lacking PPE. And I think that really helped bring it to the public's consciousness.

You mentioned the Biden administration has taken on sort of an increasing look at this, and they did the 100 day supply chain report in which they looked at semiconductors, electric vehicle batteries, critical minerals, and active pharmaceutical ingredients. So supply chains and supply chain resiliency specifically is something that's really come into the forefront of the public's consciousness made clear, of course, by the semiconductor shortage that caused folks to have a problem getting cars recently. So it's something that has been a problem for a number of policy makers in Washington for at least a decade, but really is coming to the public consciousness much, much more in the last several years.

Duncan Wood:

And you began by talking about the defense industry and security, and of course, those issues have also made a major comeback this year with the Russian invasion of Ukraine and thinking about how geopolitics and national security are impacted by supply chains, right?

Cordell Hull:

Absolutely. And to take another example, there was a story a couple weeks ago about how in the F-35 Joint Strike Fighter, our most advanced airplane, there was a single component that had a Chinese alloy in it, and it essentially shut the program down for several weeks while trying to figure out the supply chain on this. So it is issues macro and less macro in terms of COVID and PPE to a single component of a single plane, but it is something that is a front burner conversation for a lot of people in Washington. And it's something, and folks elsewhere in America are feeling acutely. And it's something that to the administration's great credit, they've spent a lot of time and a lot of effort to try and come up with ways to ensure resiliency in these sectors in which we have a great concern about getting materials.

Duncan Wood:

One of the most fascinating things that I've seen developing this year, particularly out of the Ukraine conflict, has been how we've all been concerned about ensuring that we have reliable, secure supply. In other words, being defensive about our supply chains. We've also learned how to be more offensive about our supply chains, making sure that the countries that are not friendly to us don't have access to the components that allow them to make war against us and our allies.

Cordell Hull:

That's right. That's right. And there's been a wide effort by folks in my old office at the Department of Commerce to ensure that the Russian war fighting machines are not benefiting from US technology and goods. And again, they've done a very good job of getting allies on board with that concept to ensure there's no foreign availability for these critical components for the Russians to sustain their war effort.

Duncan Wood:

Now, switching to you, Jasper, a lot of these issues are things that we've discussed before about the impact of geopolitics, the impact of globalized supply chains and increasing concerns about ESG, et cetera. Can you talk to us a little bit about the experience that you've had working in the auto sector over the past few years and seeing how we're actually able to reorient, to strengthen and to build more resilient supply chains?

Jasper Jung:

Yeah, thanks Duncan. And it's great to be here with you and Cordell and to be able to talk about such an important issue for our industry. I think as both you and Cordell have mentioned, when we look at supply chain resilience, right, this is something honestly from an industry perspective and from GM's perspective, sourcing strategies is something that we've done well for decades. We've done this well for a long time, a well-oiled machine kind of going forward and getting the components and the materials that we need to really deliver products to our customers. But I think in recent years, right, as Cordell mentioned, the geopolitics, everything that's happening in the world, the focus on ESG and human rights, the demand from consumers, the demand from all of our equities, right, as well as these events, like what's happening in Ukraine, some of the diplomatic relationships and tendencies, as we look at the dialogue between countries around the world, I think you see just more and more equities playing in the supply chain space, right?

More so than ever before. And as the industry moves towards electrification and GM aims to lead that industry transformation, that really puts an additional imperative, I think, on these resilient strategies to vertically integrate, to go deeper, to go further and to control more of our own destiny as we go along. So I think with the policy actions, with what we see kind of publicly happening, there's a lot more at play. We see a completely new ecosystem that we have to be mindful of as we move forward with supply chain resilience and supporting strategies on that.

Duncan Wood:

And all of this has to happen, being aware of all these other values and concerns that are out there. All this has to happen in a business environment where you're competing on price and quality against other companies sometimes based in other parts of the world. How do you actually square the circle on that then so that you have the cost component, the pricing, as well as being able to take into consideration all of those other factors?

Jasper Jung:

No, absolutely. It's a good question. And I think when we look at the principles, the key pillars of our sourcing strategy moving forward, right, we look at sustainability, we look at the importance of environmental sustainability as well as ethical sourcing and good governance and transparency throughout the supply chain as we go out and identify what those new suppliers and partners that we're going to go build this new future with. We look at security, obviously controlling our own destiny, just the availability and access, continued access without disruption to the key raw materials and components that we need. Scalability, right? That's critical to our strategy, right, as we move towards our targets for all EVs in the US and around the world.

And last but not least, as you mentioned, cost competitiveness. Right. We're willing to go in and look at opportunities to make sure that all four of these pillars, right, are essential to partners that we look at, to agreements that we look at, whether it's through asset rich allies, whether it's here in North America for certain components, but also working with the value chain to build out that capacity. Right. I think the CHIPS Act and the semiconductor issue really kind of put that in the spotlight, the importance of not just sourcing, but working with some partners, working across industries to build out that capacity as well. So we're leaning in, in a lot of different ways kind of guided by those four pillars.

Duncan Wood:

One last question for you right now, Jasper, which is to do with the North American approach that companies like GM have taken. Can you talk to us a little bit about that in the context of these global challenges?

Jasper Jung:

Absolutely. Even before a lot of these policy measures started coming out here in the US and some of the platforms, some of the multilateral platforms as well, we at GM have been working for several years now on that North American approach. The Wilson Center has been an important partner in some of that dialogue with key stakeholders. And I think it's great that we now have policy actions that align well with our long term plan, but that North American approach just given our footprint, given those four pillars that we had just talked about, are critical to battery raw materials, they're critical to all types of components, both low tech and high tech, chips and the semiconductor issue as well. So we do see a role for Canada, the US, and Mexico to play as we move forward as a region. And we have an important footprint across all three and partners across all three that we think can enable the scale that we need.

Duncan Wood:

It's often said that the United States is extraordinarily blessed. No. You have oceans on both sides and friends and allies to the north and the south. Yeah. That's a huge advantage. Let's turn back to an issue that we've already mentioned, which is geopolitics a couple of times, Russia, Ukraine. And the invasion of Ukraine by Russia has had cascading impacts throughout supply chains in particular to do with global food and energy supplies. But let's think beyond just Russia and Ukraine, what are the other big geopolitical challenges that you guys see out there on the horizon that need to be incorporated into both government thinking and private sector thinking Cordell?

Cordell Hull:

Well, I'll take the obvious one, China, and if for instance, if China were to move against Taiwan, and as Xi has said, reunify Taiwan, that of course would have a massive effect on supply chains, getting things out of China. But another non Taiwan example is if it became more difficult, for instance, to transit the South China Sea or the Indian Ocean, I think you'd see a lot of seaborne shipping impacted significantly. And so that would inhibit availability for any number of things we can think of. That is one that to me is the very obvious one and candidly, I think the most likely one that we're going to see in the next half decade or decade as we go forward.

In terms of what policymakers ought to be thinking about, and this is something that the Wilson Center's done a lot of work on and as well as folks in Congress and folks in the administration is building in those resiliencies, A analyzing where the gaps are, B figuring out smart policy to fill those gaps. And again, the administration did the four sectors and thinking of ways to do that. And they've published a number of executive orders. I know several other contemplated, but that is, to me, that is sort of challenge 1A, 1B, and 1C right now is China getting more aggressive in its neighborhood?

Duncan Wood:

And on semiconductors, the Wilson Center is just launching its new report on the semiconductor supply chain, which is titled of Swans and Rhinos, because we're looking at those black swan events, which we never know what they're going to be, but we need to be prepared for them. And that is the best way to prepare is resilience. And then there's the gray rhinos, the things that we know that are out there, but we haven't actually got the incentive structure to act on at this point. We need to start preparing for the impact of those as well.

Cordell Hull:

That's right. And that's something that the government needs to be thinking about as well. And candidly, industry needs to be thinking about it and industry, Jasper can speak to this better than I can, but industry moves a lot faster than the government does. And so industry is really going to be a leader in a number of these spaces and hopefully in close collaboration with our friends in government to ensure that we have a unified US policy, that we're not putting things in executive orders or the code of federal regulations or statute that industry simply can't implement, and we end up creating more problems than we solve. That is something that every good policymaker has in the front of his or her mind as they're going through this. What is the problem I'm trying to solve? Is what I'm doing going to solve this problem? But nobody knows their supply chain, like particular companies in their industry. And so having that dialogue back and forth is critical to making this work.

Duncan Wood:

So Jasper, same question for you. The major geopolitical challenges, if you want to go beyond that in terms of sort of systemic challenges, environmental challenges, what do you think are the major things that we need to be thinking about at this point in time?

Jasper Jung:

Yeah, I mean, Cordell obviously highlighted one of the biggest ones, and then we see what's happening with Russia and Ukraine as well, as you had mentioned. But I think also it's not just about looking at where we see the risk, but we look at the different platforms and the dialogue that's happening to address that risk. Some of the platforms led by the US in terms of the Indo-Pacific Economic Framework, the work with the EU on the Trade and Technology Council. I think there are platforms for further dialogue out there, but I think systemically, one of the things that we always have to remind ourself that particularly for our industry, when we look at the technologies, when we look at the value chains for electrification and for a lot of these mobility services and where the transportation industry's going to head in the future, we really see a global race underway. Right.

Some of the policy actions and the industrial policies that we see here in the US recently are a reflection of how policy really feeds into that global race. Right. But when you look at competition with China, with the EU, right, taking these national interests, but also working with your allies, it's going to be an incredibly interesting dance as we go [inaudible]. There are platforms to do it, but there's also further opportunity, I think, further dialogue within this hemisphere with our partners. We've talked about the North American approach, but how are we getting our South American partners involved as well when we look at battery raw materials, for example, which are going to be an important source of lithium down there. Right. How do we leverage that? How do we utilize that and bring that in to secure our interest, both from a national and from an energy perspective? So.

Duncan Wood:

Yeah. I think that what we're seeing there is a very simple, maybe obvious, but it's very, very important recognition that the United States cannot do this alone. In fact, nobody can do it alone, right? And so we're going to need not just coordination internally, but coordination externally with allies and friends and partners, et cetera. One thing that I feel has happened is that we are seeing an emerging consensus over some of these challenges and a recognition of the need to work across party lines. We now have a focus on supply chains that goes across administrations. We've managed to get important legislation that has come through Congress, et cetera. Those are things which I think show that there is an emerging recognition that more needs to be done. Is that true in the private sector as well, Jasper?

Jasper Jung:

Yeah, I think there is a general recognition that more needs to be done and that, as Cordell had mentioned earlier, industry can move at pace. Right. We can do things, we can lead, but also I think the reality is we cannot do this overnight and we cannot do this on our own. Right. And so that collaboration between parties across governments and industry, I think will be very important going forward. So this space, right, like we've seen everything from critical minerals to semiconductors, right, the whole supply chain resilience just topic, right, like key themes coming out of that in terms of national security, clean energy transition, a lot of opportunity there that resonates with a lot of political equities, but also a lot of industrial ones too.

Duncan Wood:

That's right, that's right. Now, we always like to say here at the Wilson Center that we have, it's a gross simplification, but we used to have supply chains based upon sort of unfettered globalization, the goal of reducing costs as much as possible. So we've moved from a focused on value to one now where we're focusing on values. Okay. And the values are security, geopolitics, environment, social governance, transparency, anti-corruption, all of these coming together. I want you to look into the future, get your crystal balls out and say, Is this now the way things are going to be for the foreseeable future? Or are we going to see, do you think a return at some point in the near future to a more simplified model where in fact, companies and governments are going to be saying, Okay, let's just do this where it's best or where it's most efficient to do it, Cordell?

Cordell Hull:

Well, the old saying, history repeats itself. So I hope that's not totally true in this context, but I think we, at least for the foreseeable future, have moved away from the liberalization, sort of the late 90s and early 2000s of getting things out, building it where it's can be built as cheaply as possible and move to market. I think for a number of items, that will still be the model. There are a number of things where we don't really care where it's built or how, we care how it's built, but cost is going to be a determinative factor for that. There are going to be a number of industries, and it's going to take the government really thinking hard about this and working with colleagues in industry to really zero in on those things that either have to be built here again, for ensuring its security or ensuring supply availability, and then things that we can perhaps nearshore to our ally or allied shore.

So I think it's going to be a little bit of a division. I think you're going to see certain things that we're just going to bring back here and we're going to manufacture here. And I think you'll see a number of components from the semiconductor value chain, for instance, and the Congress just passed the CHIPS Act on that to make that happen. I think we're going to see probably a couple of other industries where that might happen. So the short answer to your question is I think a little bit of both, but I think there going to be some critical sectors where we're going to do it here, or we're going to do it in places where we're very confident of our relationship with the ally that is hosting that manufacturing site.

Duncan Wood:

And many of these sectors, availability of human capital, availability of the technology and the intellectual property is going to be fundamentally important.

Cordell Hull:

That's exactly right.

Duncan Wood:

Yeah. Jasper.

Jasper Jung:

Yeah. No, I wanted to pick up on your theme around the human capital piece. I think that workforce, right, just will continue to be a challenge and an opportunity for us to develop good jobs across a number of sectors, skilled labor, and just really looking at ways to really kind of strengthen that value chain. And as Cordell said, I agree.

I do think it's going to be a little bit of both. I think as companies like GM continue to vertically integrate, right, and as we have more players, more influencers that are coming into our value chain and broader industrial ecosystem, right? I think that evolution will continue. Right. I don't think Mary Barra, our CEO has often said the industry will change more significantly in the next five than it has in the past 50 years. Right. And part of that change is being driven by the supply chain around resiliency efforts. And I think as we transform the industry, you're going to have the reality that you're going to need allies for certain parts, you're going to need, some of it can come to North America, right, and but I do think it's going to continue to change across both fronts, so.

Duncan Wood:

Jasper, thank you so much for being here. Cordell, thank you, always being a friend of the Wilson Center as well for this enlightening conversation, both of you. To our audience, I hope you learn as much as I have. I also hope you explore the rest of the issue available at wilsonquarterly.com.

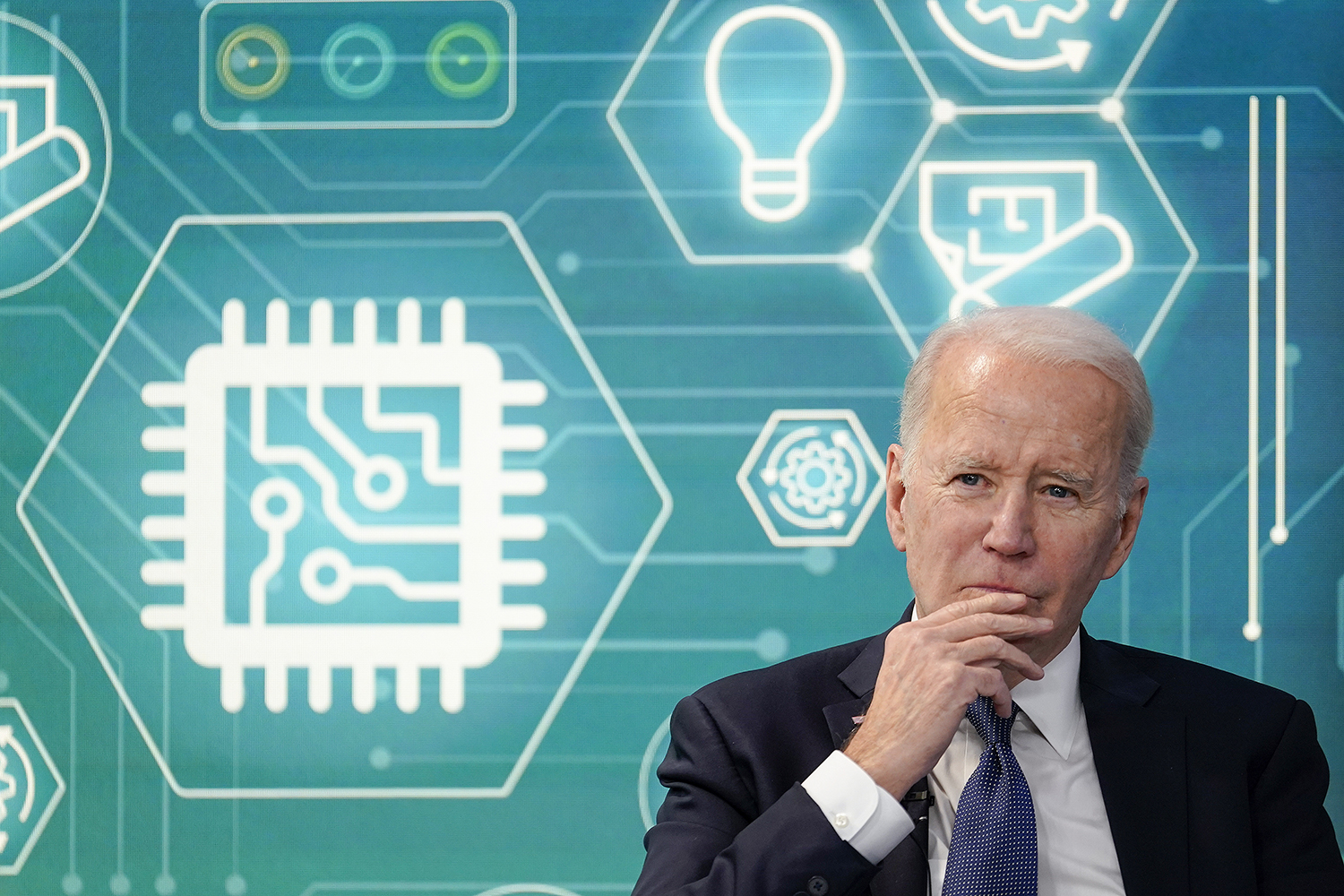

Cover photo: President Joe Biden attends an event to support legislation that he believes would encourage domestic manufacturing and strengthen supply chains for computer chips. March 9, 2022. AP Photo/Patrick Semansky.